Build Real Financial Confidence Through Practice

Most people never learn practical money management because traditional education skips the hands-on part. Our six-month program changes that. You'll work through real scenarios, build actual budgets, and develop habits that stick around after the course ends.

We're not selling quick fixes or promising overnight transformations. Just structured learning that meets you where you are and helps you move forward at your own pace.

What You'll Actually Learn

Six modules spread across six months, starting September 2025. Each one builds on the last, so you're not jumping around between topics. Think of it as putting together a puzzle where each piece actually fits.

Module One

Money Foundations That Make Sense

Start with tracking where your money actually goes. Not where you think it goes—where it really goes. You'll set up systems that work with your life instead of against it.

Module Two

Building Your Safety Buffer

Emergency funds sound boring until you need one. We'll show you how to build yours without feeling like you're depriving yourself of everything enjoyable.

Module Three

Debt Without the Drama

Debt isn't a moral failing. It's a financial tool that sometimes gets out of hand. Learn when it makes sense, when it doesn't, and how to handle what you've already got.

Module Four

Investing Basics for Real People

No jargon marathons. Just straightforward explanations of how different investment options work, what the risks actually are, and how to start small if that's what fits your situation.

Module Five

Planning Beyond Next Week

Retirement feels abstract when you're juggling today's bills. We'll break down super contributions, long-term goals, and how to think about future you without ignoring present you.

Module Six

Keeping It Together Long-Term

The hardest part isn't learning this stuff. It's still doing it six months from now. You'll build review habits and adjustment strategies that actually stick.

Who's Teaching This

Three people who've spent years working with everyday Australians on money questions. No celebrity finance gurus here, just experienced professionals who actually listen.

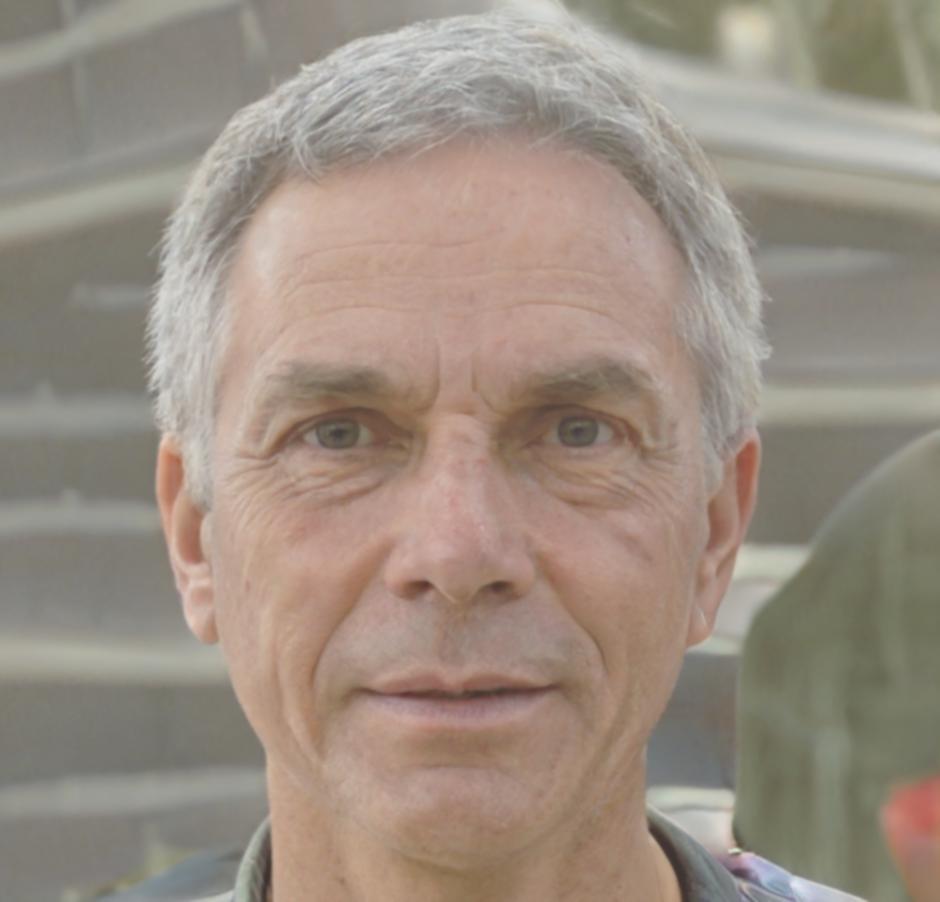

Lachlan Byrne

Financial Planning Specialist

Fifteen years helping people untangle complicated financial situations. Started in mortgage lending before moving into broader financial education work across regional Australia.

Stellan Roos

Investment Education

Spent a decade in wealth management before realizing he preferred teaching people to fish rather than selling them fish. Focuses on making investment concepts actually understandable.

Davorin Oblak

Debt Strategy Advisor

Background in credit counseling and debt restructuring. Believes most people know more than they think they do—they just need someone to help connect the dots.

How It Actually Works

Weekly Online Sessions

Wednesday evenings at 7pm AEST, running 90 minutes. All sessions recorded if you can't make it live. Watch from your couch, your kitchen table, wherever works.

Practice Between Sessions

Each week includes exercises based on your actual financial situation. Not theoretical problems about people who don't exist. Your numbers, your circumstances, your pace.

Small Group Support

Groups of eight to ten people who started together. Monthly check-ins where you can ask questions, share what's working, and hear how others are tackling similar challenges.

Resource Library Access

Templates, calculators, and reference materials you can come back to after the program ends. Everything's yours to keep and use as long as you need it.

Ready to Start?

Our next cohort begins in September 2025. Limited to thirty participants so everyone gets proper attention during group sessions. We'll open registration in May, but you can express interest now.